Swiss Solar analysts on world logistics’ crisis and PV industry

25/08/2021

The current crisis situation in the global logistics system as a whole and in the container shipping market in particular is of serious concern to business and puts experts and analysts in a quandary. A unique confluence of various unfavorable circumstances within a single year has led to serious disruptions in established supply chains and caused an unprecedented jump in prices for delivery services by sea transport.

The global nature of the phenomenon has, to various degrees, affected all sectors of the global economy. Delays in deliveries under contracts, according to the IHS Markit survey, reached the highest level in the last 20 years. The cost of container transportation in some areas increased by 350%, which could not but affect the cost of goods for the end customer.

What is known today about the causes and development of this large-scale crisis? What impact did it have on the PV industry? And what are the prospects for overcoming the crisis?

Background

The first place in the breadth of coverage and the level of impact on the global economy indisputably belongs to coronavirus pandemic.

The uncoordinated introduction of shutdowns and lockdowns around the world led to chaotic disruptions in established trade chains. At the initial stage (Q1-Q2 2020), the drop in demand led to a shrinking maritime market and an increase in freight costs. Thus, freight rates from China to Europe and the USA increased by 40-50% during this period.

However, it would be wrong to attribute all the “credit” for the logistics crisis to the COVID-19 pandemic. By the time the virus struck the global economy, the shipping market had already been sufficiently weakened. The growing trade and political contradictions between the United States and China, the protracted process of Britain’s exit from the European Union, the trade conflict between Korea and Japan and the prevalence of protectionist policies in general, all that contributed significantly to this situation.

At the same time, the need to comply with shutdown measures affected the motivation and preferences of a significant mass of buyers. The rapid growth of Internet commerce in Q3-Q4 2020 and the increased demand for certain product groups led to:

- increase in demand for sea container transportation;

- forced downtime of ships waiting to be loaded and unloaded, crew changes;

- congested warehousing facilities and spaces in ports;

- delays in moving cargo out of ports;

- inability to deliver goods to ports;

- imbalances in the U.S. turnover, which led to a huge accumulation of empty containers there and consequent shortages thereof in other countries.

Gradual removal of strict quarantine restrictions from the end of 2020 further deepened these processes, which inevitably led to an increase in freight costs. However, no one could have predicted such an incredible (up to 2.5 times) growth of freight rates. Suppliers and their customers were forced to either accept such an increase or to refuse to fulfill their contracts.

PV industry and the crisis

The fact that a considerable amount of solar panels production and its components is based China has made the PV industry one of the most vulnerable in the current situation. Already in the first months following the outbreak of Covid-19, a sense of imminent disaster gripped the entire industry. The most radical predictions of a rapid and deep market decline fortunately did not come true due to its relative inertia and the time lagged introduction of lockdowns in different countries.

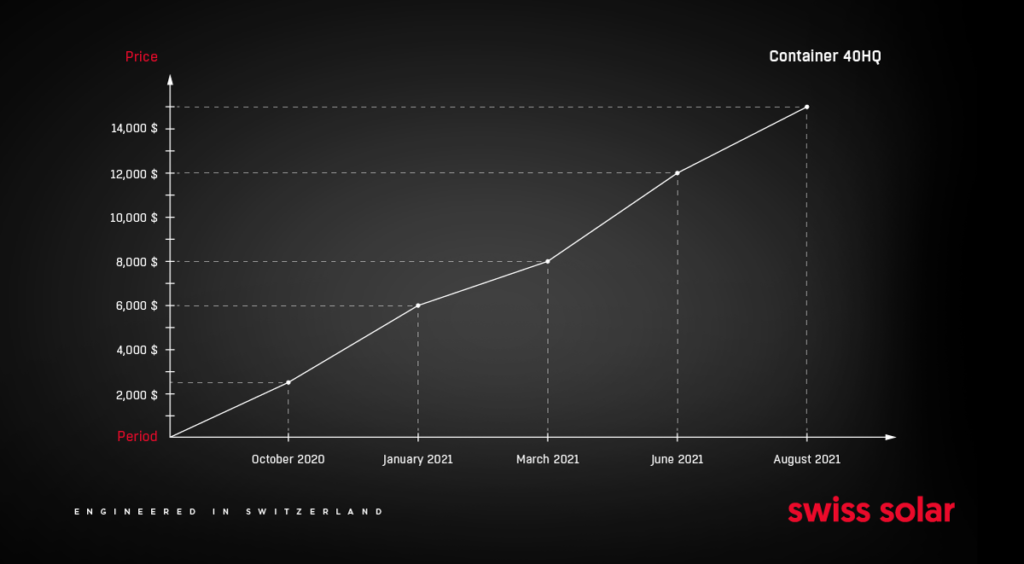

However, already in the second half of 2020, there were difficulties with the supply of the materials needed for the modules production (aluminum, steel, glass, silver, poly- and monocrystalline silicon), and their market cost increased significantly. Container shipping costs also continued to rise and reached record levels by the end of the second quarter of 2021 (Fig. 1).

Figure 1: Container costs 2020-2021.

Taken together, these factors had a serious negative impact on all groups of solar module manufacturers and consumers. But the European manufacturers were especially affected by that, as they depended on buying various materials (silicon, aluminum, etc.) and equipment in China. Ultimately, the cost of their products was fully affected by the increased transportation costs.

Manufacturers and the crisis

The crisis situation in the world markets of raw materials and container transportation forced PV module manufacturers to look for ways to resolve it. The companies faced a difficult choice: to raise prices for modules and thus transfer the increased costs to consumers, to compensate them at the expense of their own profit or find other effective solutions.

Everyone chose the most convenient option for themselves. Large, self-confident companies raised module prices, counting on the steady reputation of their products and the high purchasing power of their customers. Some manufacturers went for reducing or completely replacing expensive materials (aluminum) in the construction of the module frames. Others compensated the increase in costs at the expense of their own profits, explaining to their investors the decline in profitability due to high prices for raw materials and logistics.

Swiss Solar AG was also confronted with the fact that the cost of the module increased significantly due to the high cost of transportation. But as a serious manufacturer of class A modules, the company will never go for cheaper and more accessible materials and cheaper production in general. The company’s management made a decision to keep the high quality of the product and keep the market value as much as possible so that the company’s distributors would remain competitive in their markets. In order to achieve this goal, the company chose the strategy of purchasing a large volume of components for production, which allowed to restrain the price growth as long as possible. Price retention was also achieved by reducing the profits of Swiss Solar itself.

In general, it seems that many companies do not seek to shift the burden of increased transportation costs onto the consumer’s shoulders. This can be explained both by the rather high competitiveness of commodity markets and, in some cases, by the impossibility to do so under the terms of previously signed contracts.

Some states have also taken an active part in tackling these problems. China, for instance, realizing the need to maintain its reputation as a reliable supplier and manufacturer, subsidized local shipping companies for the delivery of empty containers from the European Union and the United States. This helped solve the problem of the huge amount of cargoes piled up in Chinese ports waiting to be shipped away.

At the same time, the lack of prospect in reducing the cost of transportation still forces companies to pass additional costs on to consumers, placing high delivery costs in new contracts.

Consumers and the crisis

The acute shortage of empty containers affected not only the work of companies whose production facilities are located in China or are linked to it by deliveries. Everyone needs to move goods between markets, from the largest multinationals to small wholesale traders, and the increased cost of freight not only affects the interests of producers, but also has a serious impact on the cost of goods for end customers.

It was not difficult to predict the reaction of consumers. The steady decline in the cost of solar panels in the years leading up to the pandemic was a decisive factor in the transition of solar power from exotic to profitable business. Thus, the sudden reversal of the already familiar declining cost trends is an understandable concern for business and requires time to analyze the situation and to make decisions.

The logistics crisis primarily affected companies involved in large-scale solar energy projects. They need much more panels, materials and equipment than installers of systems for home use. And in most cases all this has to be delivered from other countries. Both tend to take a wait-and-see approach wherever possible.

Some companies use staged project management, which also allows them to postpone the purchase of solar modules and equipment for a while. However, those who have to fulfill the contracts signed back in 2020 are in a really difficult situation.

Prospects for recovery

The time lag in the cancellation of lockdowns in different countries, the different speed of economic recovery against the rapid economic recovery in China still maintains the disbalance in the international logistics market. Any forecasts in such situation cannot claim to be absolutely accurate, as any, seemingly insignificant, factor can affect the market conditions and change the current situation. A vivid example is the incident with the container ship “Ever Given” grounded in the Suez Canal, which led to delays in loading and unloading ships in European ports and, consequently, to an increase in the shortage of available containers.

Analysts agree that the unpredictable influence of destabilizing factors on international logistics pricing may persist until the pandemic is completely eliminated and established supply organization models are restored. In the short term (for the period up to Q1 2022), we should expect prices for PV industry materials and their transportation to continue to rise.

To summarize the current state of affairs, we quote Lars Jensen, CEO of the Copenhagen-based consultancy SeaIntelligence, in his interview with The Washington Post: “There’s only one thing that can fix this, and that’s time”.

https://www.washingtonpost.com/business/2021/01/24/pandemic-shipping-economy/